Maryland’s adult-use cannabis market generated around $72.9 million in state revenue in 2024 through a 9% sales-and-use tax. However, state officials, including Governor Wes Moore, have announced plans to raise this tax rate from 9% to 12% by July 2025 to help address a significant budget deficit.

The tax increase, part of a broader fiscal plan aiming to close a $3.3 billion structural gap, is projected to add approximately $39 million in revenue annually, though current sales trends suggest this estimate may be optimistic. With Maryland’s adult-use cannabis market averaging $900 million in annual sales, the additional 3% tax would realistically generate around $27 million extra per year.

Cannabis industry stakeholders have expressed concerns that higher taxes could negatively impact businesses, potentially driving consumers away from licensed dispensaries due to increased product costs. On average, each of Maryland’s 100 dispensaries could face an additional $270,000 in annual taxes.

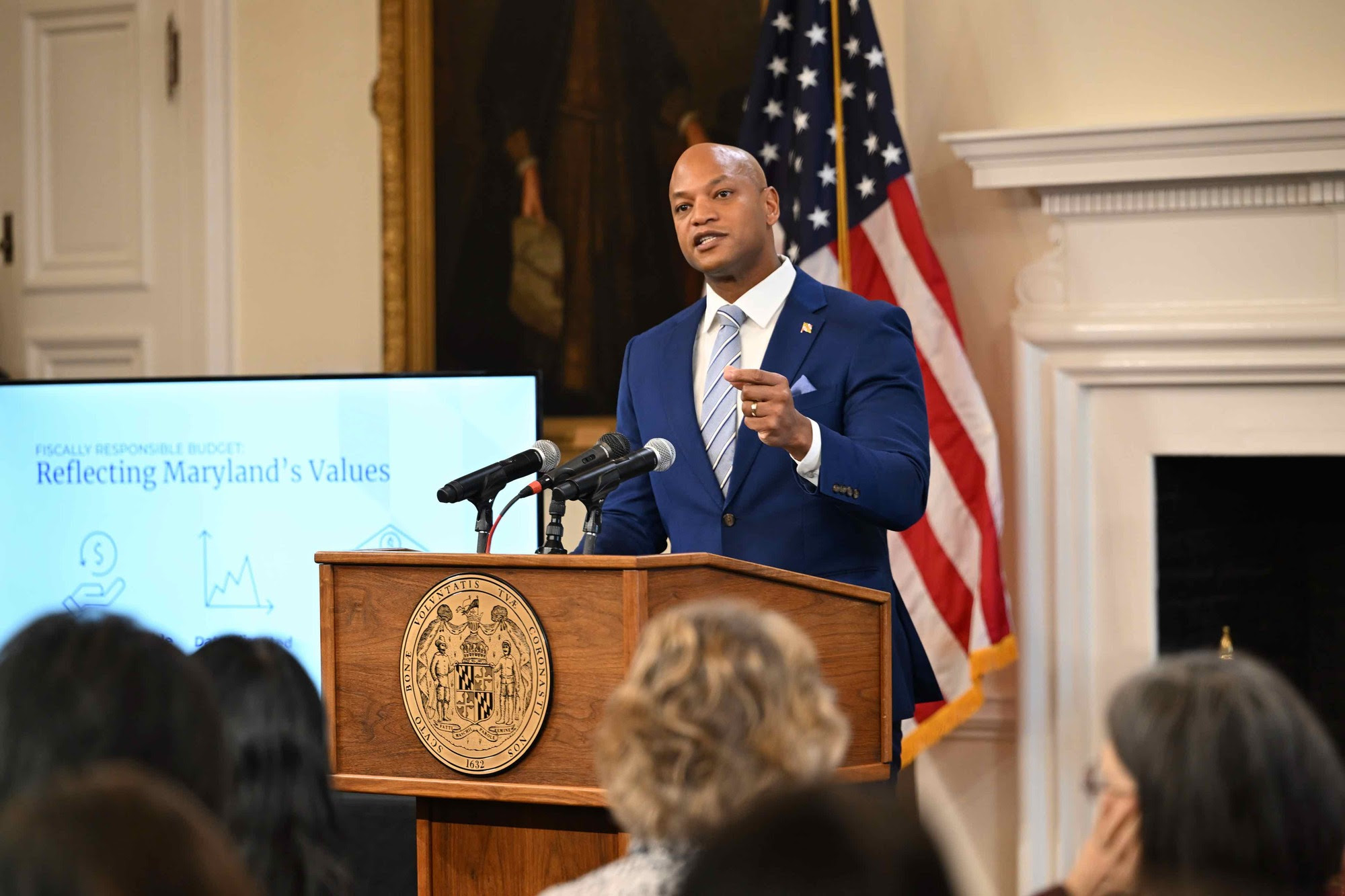

Governor Moore defended the move, emphasizing the necessity of fiscal responsibility, economic diversification, and business growth, despite potential challenges for cannabis retailers. The broader budget deal also includes over $2.3 billion in spending cuts, marking the state’s most significant expenditure reductions in 16 years.

Initially, Maryland set the cannabis tax at 9%—matching the tax rate for alcoholic beverages—when adult-use cannabis was legalized via voter referendum in 2022. The recent budget agreement notably did not include adjustments to alcohol taxation.